Nigeria has been a thriving center for financial technology, or fintech, in recent years. The combination of technology and finance has resulted in a plethora of creative startups and businesses that are revolutionizing the accessibility and delivery of financial services.

In this post, we’ll take a look at some of the best fintech companies in Nigeria. This post will be very insightful so we urge you to read it to the end.

Table of Contents

WHAT IS FINTECH?

FinTech is a play on words that combines the terms “technology” and “finance.” Put otherwise, Fintech is simply the abbreviation for Financial Technology. Therefore, one can say Financial Technology instead of Fintech and the other person will still be correct.

Fintech refers to innovative technology designed to enhance and streamline the provision and utilization of financial services. Fintech is primarily used to assist organizations, entrepreneurs, and consumers in managing their financial operations, workflows, and personal finances more effectively. This is a new sector of the economy that leverages technology to enhance financial operations.

BEST FINTECH COMPANIES IN NIGERIA

The following is a list of some of the best fintech companies in Nigeria:

1. Flutterwave

Head Office: Lagos and San Francisco

CEO: Olugbenga Agboola

At the top of our list of best fintech companies in Nigeria is Flutterwave. Flutterwave is a Nigerian fintech company that provides a payment infrastructure for global merchants and payment service providers across the continent. It is worth more than any bank in Nigeria, with a current valuation of $3 billion.

Flutterwave serves over 280,000 companies that use its cutting-edge platform to conduct business. Currently, this leading Fintech company in Nigeria works in thirty African nations and is a very secure and dependable cross-border payment platform.

2. PiggyVest

Head Office: Lagos

COO: Odunayo Eweniyi

Next on our list of best fintech companies in Nigeria is piggyVest. Piggyvest is a platform that helps individuals and businesses manage their finances effectively – save and invest with ease. With its distinctive approach to investing and saving, PiggyVest encourages users to set aside money for particular objectives and gives them access to investment opportunities in the Nigerian capital market.

PiggyVest was founded by Joshua Chibueze, Somto Ifezue, and Odunayo Eweniyi in 2016. The cutting-edge features of PiggyVest, such as group savings and investing possibilities, motivate users to meet their financial objectives and establish long-lasting savings habits.

3. Opay

Head Office: Ikeja, Lagos

CEO: Mr Daudu Gotring,

The next company on our list of best fintech companies in Nigeria is Opay. With services like food delivery, financial products, and ride-hailing, Opay has developed into an all-in-one super app that is revolutionizing the way consumers interact with technology.

The app has established itself as a vital resource for anyone looking for easy access to a variety of services on a single platform. Opay is one of the largest fintech companies in Nigeria as it’s worth more than $2 billion and has achieved unicorn status.

The financial company saw remarkable growth during the worldwide pandemic lockdown, with the value of its gross transactions rising by more than 450% to over $2 billion in December 2020. According to the corporation, it now transacts more than $3 billion each month. The solid network of its 300,000 agents and 5 million registered app users nationwide is what powers this.

You Should Read: 13 Top Fintech Companies To Know

4. Paystack (Acquired by Stripe)

Head Office: Ikeja, Lagos, Nigeria

CEO: Shola Akinlade

Next on our list of best fintech companies in Nigeria is Paystack. Paystack is a payment processing company that allows companies in Nigeria to easily accept payments online and offline. Since its founding in 2015, the company has expanded to rank among the nation’s most well-known payment gateways.

Paystack is renowned for its intuitive user interface and cutting-edge security features, which facilitate organizations’ safe and effective transaction processing. Paystack was established in 2015 by its CEO, Shola Akinlade, and CTO, Ezra Olubi. The company’s guiding principle is that, despite the challenges of starting a business, receiving payment shouldn’t be one of them.

Through the company’s platform, merchants can take payments from clients using bank transfers, mobile money, and debit and credit cards. Paystack has rapidly emerged as the preferred payment option for companies operating in Nigeria, with more than 60,000 merchants currently utilizing the platform. Stripe purchased the Paystack in 2019 for $200 million.

5. TeamApt

Head Office: Lagos

CEO: Tosin Eniolorunda

The next company on our list of best fintech companies in Nigeria is TeamApt. TeamApt is a fintech company that develops products to improve efficiency, facilitate easy payments, and promote business expansion.

TeamApt was founded in 2015 by Tosin Eniolorunda. The solutions offered by TeamApt are aimed at improving financial inclusion and digital payments. Its specialty is creating scalable solutions that enable companies, including banks, to prosper in the digital era.

TeamApt’s solutions, which range from digital banking platforms to payment processing systems, have been instrumental in enhancing the effectiveness and availability of financial services. Through creative ideas, TeamApt has improved Nigeria’s financial infrastructure significantly.

6. SendBit

Head Office: FCT, Abuja

CEO: Jude Chinweike Obiejesi

The next on our list of best fintech companies in Nigeria is SendBit. SendBit is your fast pay spot that enables you to accept PayPal payments, purchase airtime and data bundles in single or in bulk, trade, and more. SendBit is a financial technology company that is a product of Techibytes Media, and not a bank. They collaborate with authorized service providers, banks, and other partners inside their respective jurisdictions to sell their goods and services.

SendBit is your one-stop shop for quick payments. With its easy-to-use platform, you can buy airtime and data bundles in single or bulk amounts, exchange gift cards, and more. You can even accept PayPal payments. It offers both consumers and businesses a wide range of financial services that are convenient and flexible.

You can easily download the SendBit app from the Google Play Store or the App Store.

SendBit is still improving the quality of services it renders as it promises to introduce Dollar virtual cards, Gift card trading, and USD accounts pretty soon. These features will further simplify your online transactions.

7. Interswitch

Head Office: FCT, Abuja

CEO: Mitchell Elegbe

Interswitch is next on our list of best fintech companies in Nigeria. Within the Fintech environment in Nigeria, Interswitch continues to be a trendsetter. This company has been essential to the development of the country’s digital payment system. Interswitch has raised the bar for electronic transactions by providing flexible payment solutions for businesses and enabling online payments.

Its technological innovations have revolutionized the way Nigerians perform financial transactions, positioning it as a key player in the Fintech movement. Mitchell Elegbe created the company in 2002 to facilitate payments and facilitate transaction switching.

Verve, point-of-sale terminals, online consumer payment systems, and ATM cards are some of the financial goods that InterSwitch offers. Interswitch reported in 2019 that it handled more than 500 million transactions each month. In the same year, the business bought a 60% share in the health technology startup eClat.

You Might Want To Read: The Top 10 Popular Fintech Companies in Nigeria

8. Cowrywise

Head Office: Ikeja GRA, Lagos Nigeria and San Francisco, CA, USA.

CEO: Razaq Ahmed, CFA

Next on our list of best fintech companies in Nigeria is Cowrywise. Cowrywise enables both novice and seasoned investors to invest by offering professionally managed portfolios. Investing in mutual funds and other investment vehicles becomes simple when using Cowrywise even for individuals who are unfamiliar with money.

Cowrywise has revolutionized the investment landscape for Nigerians by providing convenient access to a wide range of investment possibilities. With little entrance restrictions, its website allows users to invest in a variety of assets, such as government bonds and stocks.

9. Kuda

Head Office: Yaba, Lagos, Nigeria

CEO: Babs Ogundeyi

Kuda is next on our list of best fintech companies in Nigeria. Kuda is a branchless bank that provides hassle-free mobile banking through its app, which includes investing, saving, and budgeting.

Its fee-free transactions and user-focused philosophy have won it a huge following, especially from younger people. Through its app, Kuda, also known as Nigeria’s digital-first bank, provides several banking services.

10. Carbon

Head Office: Lagos Nigeria

CEO: Chijioke Dozie

Carbon is next on our list of best fintech companies in Nigeria. Carbon is a lending app for Nigerians. It was formerly known as Paylater. This company offers loans to Nigerians via their mobile application, saving them the trouble of applying for loans through banks.

Carbon was founded in 2016 under One Finance Limited. You can use the app to obtain loans without presenting any paperwork, and their services are readily available. The carbon app is known for its speed, ease of use, elegant design, and effectiveness.

In 2019, this leading Fintech company in Nigeria made up to $10.4 million in income and had disbursed at least $35 million in loans. At the AppsAfrica Awards, Carbon was recognized as the Best FinTech Solution in Africa and has since maintained its position as one of the leading Fintech companies in Nigeria.

11. Geegpay

Head Office: Lagos

COO: Richard Oyome

Geegpay is next on our list of best fintech companies in Nigeria. Geegpay provides several financial services, such as loans, insurance, and payments. The Nigerian-founded company is well-known for its creative approach to financial services, utilizing cutting-edge technology to simplify and expedite the acquisition of financial goods and services for both individuals and enterprises.

The best part about Geegpay is that you can open foreign bank accounts in your name and use them for transactions like PayPal and Payoneer withdrawals. You can also receive money directly from clients overseas into your foreign account and exchange USD at black market rates right on the Geegpay platform, saving you the trouble of visiting a bank.

You Should Also Read: Best Islamic Banks In The UAE

12. Chipper Cash

Head Office: San Francisco, California

CEO: Ham Serunjogi

The next company on our list of best fintech companies in Nigeria is Chipper Cash. Chipper Cash is a cash-transfer app that facilitates the sending of private payments to friends and family. Their principal operating regions include African nations, such as Ghana, Kenya, and Nigeria. The fintech startup was valued at $2 billion and received $150 million in November 2021.

13. Remita

Head Office: Lagos Nigeria

CEO: Deremi Atanda

Remita is also one of the best fintech companies in Nigeria. It is one of Nigeria’s leading online payment providers that assists both people and businesses with bill collection, payment processing, and money management across numerous banks.

This fintech company in Nigeria took off and eventually became the government of Nigeria’s only source of income collection. Since then, Remita has developed into a completely effective payment platform for both people and businesses.

14. Paga

Head Office: Lagos Nigeria

CEO: Tayo Oviosu

Next on our list of best fintech companies in Nigeria is Paga. Paga has simplified the process for consumers to send and receive money in the country. Paga was started by Tayo Oviosu in 2009. Paga is a tried-and-true, speedy, mobile payment provider. By dialing the code *242#, consumers can make payments even in the absence of an internet connection.

Paga’s original intention was to allow users to send money without incurring fees. Over time, though, the business added more capabilities that let users pay their bills, transfer money into banks, and make in-store purchases. The platform of the company is accessed through a mobile application, with over 14 million users. Paga has raised more than $50 million in capital, and its investors include Visa and Mastercard.

15. PalmPay

Head Office: Lagos Nigeria

CEO: Chika Nwosu

PalmPay is one of the best fintech companies in Nigeria. Since it was founded in 2019, Palmpay has grown rapidly to become a leader in the African fintech market. Because of its partnerships with Tecno, Intel, and Infinix, Palmpay’s app can come pre-installed on certain devices.

Through the company’s corporate product, customers can take advantage of the dependable network and customer-focused solutions that Palmpay has developed to expand their companies. The Central Bank of Nigeria has granted the app a license to operate as a mobile money provider, and NDPR compliance is followed when handling user data.

With over 5 million users who can send and receive money, pay for airtime and bills, shop, and save money with discounts and cashback, it’s one of the fastest-growing fintech companies in Nigeria. 99% of Palmpay users rated the payment network as the most dependable in the nation in a recent survey.

16. eTranzact

Head Office: Lagos Nigeria

CEO: Olaniyi Toluwalope

Etranzact is one of the oldest Fintech companies in Nigeria. It is the first award-winning multi-application and multi-channel electronic transaction switching and payment processing platform. eTranzact also owns other companies such as ATM CardlexCash, CorporatePay, PocketMoni, Mobile Topup, and BankIT.

Since its founding in 2003, etransact has handled payment requests from a variety of channels, including POS, ATM, Web, and mobile automated transactions. Etranzact is also active in Kenya, Ghana, Zimbabwe, and Cote d’Ivoire, among other African nations. It functions in the United Kingdom as well.

You Might Also Like: List of Best Finance Companies in Nigeria

17. Lidya

Head Office: Maryland, US and Lagos, Nigeria

CEO: Tunde Kehinde

Next on our list of best fintech companies in Nigeria is Lidya. Lidya is a pioneering fintech business in Nigeria that has made it their main goal to assist SMEs. Lidya is transforming the financing process for small businesses with its easy-to-use digital platform, which provides fast and convenient access to money.

Lidya effectively evaluates creditworthiness through data-driven analysis, bridging the gap between SMEs and the financing required to support their expansion. Lidya has become a lifeline for numerous struggling small and medium-sized enterprises (SMEs) due to its user-friendly design and specialized lending solutions. Through streamlining the loan application process and providing competitive interest rates, Lidya promotes job development and economic progress throughout Nigeria.

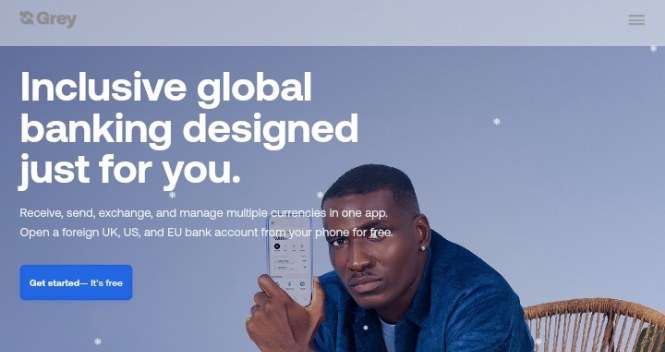

18. Grey

Head Office: Vancouver, Canada

CEO: Idorenyin Obong

Grey.co is a fintech startup that offers financial management and payment processing services to Nigerian businesses. The company was established in Nigeria and is well-known for its sophisticated security features and user-friendly platform, which make it simple for companies to handle transactions securely and effectively. The organization provides services like virtual cards, foreign accounts, and exchange rates on the black market.

19. Risevest

Head Office: Lagos, Nigeria and Columbia, USA

CEO: Eke Urum

Wrapping up our list of best fintech companies in Nigeria is Risevest. Risevest is transforming the Nigerian investment scene by enabling anyone, regardless of financial situation, to participate. Risevest makes it simple for people to invest in international assets, such as equities and real estate, with its user-friendly software.

The educational resources available on the platform equip users with the necessary knowledge to make well-informed investing decisions. Risevest is educating a new generation of financially astute Nigerians by deciphering intricate financial language and providing information on a range of investment possibilities.

WILL BANKS FACE A THREAT FROM FINTECH COMPANIES IN NIGERIA?

Many people share this viewpoint. They think that banks are starting to face threats from fintech. That is, of course, subjective because Fintech is an enabling technology. Even banks will be able to improve and provide better customer service as a result.

However, it can also pose a serious threat to any banks that choose not to listen. No bank can function properly if it does not adopt technology, either fully or partially. Many Nigerian banks are adopting fintech with great vigor, and the end user can only benefit.

Fintech innovation has benefited several organizations as well as the ecosystem as a whole. These developments include but are not limited to, neo-banking, internet transactions, investment and insurance programs, and mobile bill payments.

Since the fintech sector has a legislative framework in place to promote financial inclusion in other industries, it is expected to grow much more in the years to come.

According to research, Nigeria’s fintech earnings in 2022 are projected to be $543.3 million. This will be a significant rise over the $153.1 million in income from the previous year. Fintech has enormous potential in Nigeria’s economy.

CONCLUSION

When the CBN introduced the cashless economy some years back, many people thought it wouldn’t be possible. But here we are today, fintech companies in Nigeria are making waves around the world simplifying payment processes.

These thriving fintech companies in Nigeria are setting the pace and trailing the blaze for Nigerians and Africans.

We hope you found this post as insightful as promised. Share your thoughts with us in the comment section below.

REFERENCE

- https://nairametrics.com

- https://vtu.ng

- https://thebrimfactor.com

- https://www.linkedin.com

RECOMMENDATIONS

- How Open Banking Fintech in Africa will shape the continent

- List of Top Biggest Fintech Companies in America

- From Fintech to Football, Shola Akinlade launches Sporting Lagos FC

- African fintech Flutterwave valuation to over $3B after $250M Series D fund

- Ghanaian Fintech Float raises $17,000,000 seed to accelerate credit offerings for SMEs

- How Nigeria Fintech Brass a to provide a far-reaching banking solution for African businesses