Building wealth is everyone’s desire, and as such begs the question, “Where to Invest money to get good returns? And this is not only a question of choosing the best stocks or selecting between equities and bonds. It is making appropriate financial decisions centered on your objectives or, more precisely, when you might be reliant on the proceeds of your investments.

The most important thing is to choose investments that you are informed about and that are appropriate for your objectives, time horizon, and financial resources.

The study can be done by yourself if you have the time or interest to do so. If you don’t have the time or inclination to complete the research yourself, it may be wise to seek professional guidance from an expert advisor who can help you to take stock of your unique situation and make recommendations on the most effective methods to put your money to work.

Whether you choose to invest on your own or with the assistance of a qualified financial advisor, the following is an overview of the key categories of investment alternatives.

WHAT IS THE BEST PLACE TO INVEST MONEY RIGHT NOW

The following are the greatest areas to invest or keep your money right now

(1) Silver and gold,

(2) cash kept in a safe at your residence,

(3) in FDIC-insured institutions, up to a maximum of $250,000

(4) Place a wager against commercial lending,

(5) agricultural land,

(6) Rental properties at a reasonable price, or

(7) Assembling a deposit for a home AND Cryptocurrency

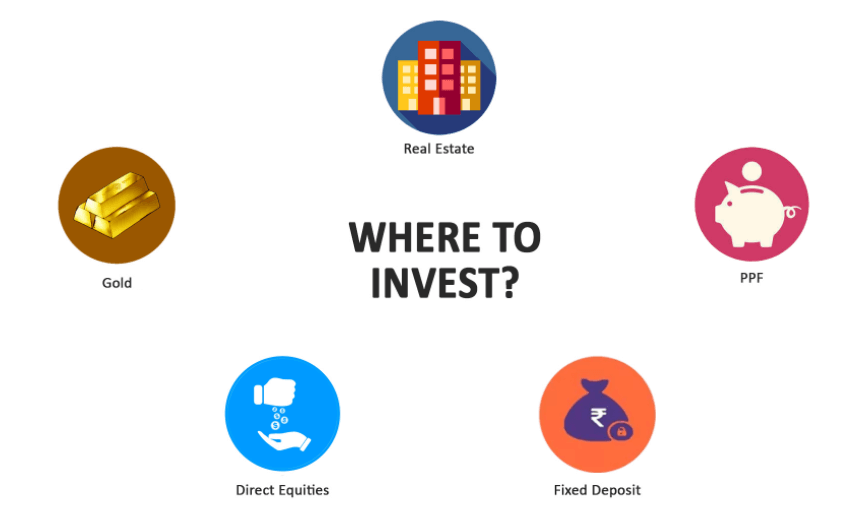

WHERE TO INVEST MONEY TO GET GOOD RETURNS

Listed below are 8 safe investments with high returns;

High-Yield Savings Accounts:

The high-yield savings account is often regarded as the gold standard of risk-free investments, as it provides consistently high returns despite the absence of any risk. In practically every bank, the money you have hidden away is protected by the Federal Deposit Insurance Corporation, which means that the government will reimburse you for any losses up to a maximum of $250,000.

In the case of high-yield savings accounts, one of the few drawbacks is that the interest rate can fluctuate in response to current market conditions. Especially when interest rates are declining, as they have been over the past few years, distributions can appear less appealing.

A range of interest rates is currently offered by the best high-yield savings accounts, ranging from $0.45 to $0.61 percent, which is a long cry from the 2 percent-plus interest rates that were available only a few years ago. Despite this, with the national average savings rate lingering around 0.06 percent, high-yield savings accounts are still a fantastic investment opportunity.

The Federal Deposit Insurance Corporation’s insurance ensures that your money is completely safe and easy to access in an emergency, and the rates are far higher than the national average savings account rate. Putting money aside for an emergency; investors looking for low-risk investment opportunities.

Certificates of deposit (CDs)

This investment approach is a viable alternative to traditional savings account investments. It provides a better rate of return than savings accounts, but it requires you to commit to a specific saving time during which you are unable to withdraw your money. The length of a saving period can range from a few months to a few years. If you choose this option, you will also receive protection if the bank that holds your deposits encounters a problem.

Consider the following points when purchasing a CD:

- Whether or not you may require that money even before the CD’s maturity date is a separate question. If the answer to that is yes, you will want to search elsewhere for your next position.

2. Whether or whether you are receiving a higher interest rate than what is offered with high-yield savings accounts is up for debate. The only advantage of a CD over a savings account is that you will earn higher interest rates. If you can find a savings account that pays more than the CD at your bank, there is simply no value in keeping the CD.

3. Having said that, while the returns on an FDIC-insured CD may appear low, they are quite good when seen in the context of the near-total lack of any danger to you of losing money.

4. CDs should provide greater yields than most savings, but this comes at the expense of flexibility, as you will be charged a penalty if you withdraw your money before the term of the CD has expired.

5. Money that you are confident will not be needed during the period specified; investors with a steady financial picture who wish to avoid taking any risks with their investments.

Money Market Accounts

Money Market Accounts are a safe and secure way to invest your money and save for the future. They operate as a certificate of deposit or savings account, with a few exceptions. Compared to standard checking and savings accounts, they provide a higher rate of return; but, you are limited to the number of checks you can make against them each month.

According to the bank, you are only allowed to issue 6 checks each month against the account amount, or else the bank will require you to open a checking account, which is typically one that does not yield interest. The Money Market account provides numerous benefits to individuals who are looking for a different way to save their money in a safe and secure environment. They can keep their wealth better out of reach of inflation, maintain liquidity, and generate more than the other deposit products by investing in these items.

These investment instruments are appropriate for someone with a reduced risk profile who wishes to get a respectable return on their money with minimal danger. Young investors may use these types of accounts to hold their down payment savings or to accumulate an emergency reserve for unforeseen circumstances.

People in their golden years may prefer them as lower-risk investments that will supply them with cash when they need it in retirement. The CIT Bank provides a competitive Money Market Account (MMA) that is well worth considering for your savings needs because there is no risk associated.

Municipal Bonds

Municipal bonds, which are issued by state and municipal governments, are a desirable investment option since they offer significantly higher yields with just a little increase in risk than other investments. There is essentially little likelihood that the United States government will fail, although there have been instances of major cities declaring bankruptcy and causing its bondholders to lose a significant amount of money.

However, the majority of people are undoubtedly aware that a major city filing for bankruptcy is quite unlikely — however, if you want to be extra safe, you should avoid any cities or states with large, unfulfilled pension obligations.

A further benefit of munis is that they are not subject to federal income tax because the federal government has a vested interest in maintaining borrowing costs for state and local governments as low as possible. Not only are they typically still safe, but they also have the extra benefit of lowering your tax bill when compared to many other alternatives.

This type of debt, which is issued by state and local governments, is slightly riskier than treasuries, but it has the added benefit of not being subject to federal income tax. Take up slightly greater risk in pursuit of marginally greater rewards; invest while attempting to keep your tax burden as low as possible; investors seeking relatively safe bonds.

Corporate Bonds

Corporate bonds, which are more risky than Treasury bonds and often municipal bonds, increase the level of risk even further. Even yet, if you opt to stay away from problematic businesses and instead invest in huge, blue-chip corporations, you will most likely be in a better financial position.

If you want to avoid taking on extra risk, avoid investing in the lower-rated debt securities available, which are referred to as “junk bonds.” Although they are higher-yielding investments, the additional risk you take on is not going to be worth it if you do not have any prior experience.

Corporate bonds can be purchased through corporate bond funds like how government bonds are purchased through bond funds and this is one of the best investments to make money. This allows you to make several investments in a variety of reliable firms and receive regular cash distributions from the fund as a result of your investments. Corporate bonds are high-risk, high-return investment options for your portfolio that you should consider.

As long as you stick to quality organizations with high investment-grade ratings, your money will most likely remain secure in sound financial institutions.

Mutual funds

Mutual funds enable you to purchase a collection of equities in a single transaction. In most cases, a professional manager oversees the fund and makes investment decisions for the entire portfolio; however, keep in mind that you will be charged a percentage-based service charge, which is referred to as an expense ratio.

Of course, identifying and selecting the most appropriate funds for your particular situation might be difficult. There are over 9000 mutual funds to choose from in the United States alone. The same as with stocks, you must choose your fund investments with care, and the enormous amount of possibilities available can make this process almost equally difficult as selecting the appropriate equities for your portfolio as an investment.

Treasury Inflation-Protected Securities

In response to inflation, many people have turned to Treasury Inflation-Protected Securities, also known as TIPS. Your interest charges will be significantly lower than the rate you would collect on a traditional treasury of the same period. You are, on the other hand, willing to accept the lower interest rate because your principle will increase or decrease in value following inflation as determined by the Consumer Price Index.

If inflation unexpectedly rises to 5 percent, everyone holding TIPS will be well-positioned, whereas those who purchased bonds at a fixed 2 percent rate will be losing 3 percent per year on their investments.

If you have to trade treasuries before they mature, you subject yourself to a slew of additional risks, so you should be certain that you will not need to access that money before they mature, just as you would with any other treasuries. TIPS pays lower yields, but the principal value of the bond will increase or decrease in value depending on the current inflation rates during the period in which you hold the bond.

Money that you believe you won’t need before the bond’s maturity date; funds over the $250,000 guaranteed by the Federal Deposit Insurance Corporation; investors looking for treasuries who also want to eliminate inflation-based risk from their portfolios are all good candidates for Treasury bonds.

Dividend Stocks

For a variety of reasons, dividend stocks are particularly attractive investment opportunities. In the stock market, dividends are regular cash payments made to shareholders. They are the most straightforward means for a company to return the profits of its business to its owners. It also often indicates some significant changes in the risk profile of the stock in question.

When determining the risk of a stock, it is important to consider the following factors:

1. That dividend is far more steady because it is given out regardless of whether the stock is rising or falling in value. Even if your stock is underperforming in terms of its share value, you will still receive a dividend, which will make it simpler to hang onto the stock and ride out a downturn.

2. The dividend works as a sort of bulwark against the possibility of a share price decline. When it comes to dividends, they are calculated as a per-share payment, but investors are more interested in the “dividend yield,” which is the proportion of a company’s share price that will be distributed as dividends in a given year. As stock prices decline, you will be paying less for the same amount of dividend income.

3. The higher the dividend yield rises, the more difficult it will be for bargain-hunting income investors to pass up the opportunity. That won’t make much of a difference for a firm that is clearly on its way to bankruptcy — a lousy investment regardless of the dividend yield — but it will help to keep the share price of a company that is simply going through some difficult times elevated.

4. Companies have the ability and will cut their payouts in times of acute adversity. Because people value stability in dividend payments, they respond negatively when a dividend looks to be less secure. Dividend payments, on the other hand, are less secure than the coupon payment on a bond, for example, which is set at a specific amount.

5. That yet, if you look for firms that not only offer a high yield but also have a lengthy track record of increasing their dividend on a steady basis — companies that are frequently referred to as “dividend aristocrats” — you may reduce a significant amount of that risk.

HIGH-RISK INVESTMENTS

Cryptocurrency Assets

Cryptocurrencies, block chain enterprises, cryptocurrency funds, and initial coin offerings (ICOs) are all examples of crypto assets (ICOs). Certain digital assets, such as bitcoin, have piqued the curiosity of investors and members of the financial media in recent years. Because of their speculative nature, these goods are regarded as high-risk investments.

When discussing crypto assets, many individuals use the word “cryptocurrencies” to describe them. Even though many crypto assets are digital media of exchange (and hence behave in a similar way to currencies), not all that is thought to as a cryptocurrency is an electronic medium of exchange; instead, it could be a crypto asset with additional characteristics.

Not all digital assets are considered securities. The BCSC exclusively supervises crypto assets that are classified as securities under the laws of British Columbia.

Foreign Exchange

Foreign exchange, also known as forex, is transacted all over the world in a decentralized market based on the simultaneous purchase of one currency and the sale of another currency. Over-the-counter trading occurs primarily in the over-the-counter market when brokers and dealers engage in direct negotiations with one another to ascertain the relative values of different currencies.

Forex trading can be done in a variety of ways, including:

Spot FX refers to the settlement of cash transactions by the immediate delivery of the acquired currency at current rather than future pricing.

In the case of currency futures, contracts for a specific currency at a fixed price are entered into to be bought or sold at a later period.

Currency options are contracts that give the holder the right to purchase or sell a currency at a certain price.

Agreements that address an exchange rate between two currencies, but in which there is no purpose to deliver the referred currency, are known as forwarding contracts. They are frequently traded over the Internet.

Trading in spot fx contracts is not currently regulated by the BCSC, although trading in other types of forex transactions is governed by the BCSC.

Hedge Funds

A hedge fund is a type of investment fund that employs sophisticated investment strategies and invests in a wide range of assets. Instead of employing the typical ‘buy, hold, and sell’ strategy, hedge funds employ alternative tactics such as short selling, leverage, and trading in commodities on an exchange or in the over-the-counter market.

Private placements of hedge funds are typically organized as open mutual fund trusts or limited partnerships, and they are issued through a prospectus exemption, sometimes in conjunction with an offering agreement, which provides investors with less information than a brochure. Hedge funds, as opposed to conventional funds, often require larger minimum initial commitments.

Generally speaking, hedge funds can be divided into three categories:

Separate hedge funds that are dependent on the investment choices of a single fund manager are known as standalone hedge funds.

funds of hedge funds is a fund that invests in units of other hedge funds that are managed by various people.

Product types such as hedge funds and other financial tools that allow investors to engage in the returns of the implicit hedge fund while also ensuring that they receive their initial investment back at maturity are known as principal-protected products.

Inverse & Leveraged ETFs

To generate a return that is a multiple of the daily value of the underlying index, a leveraged Exchange Traded Fund (ETF) is created. An inverse exchange-traded fund (ETF) seeks to attain daily performance that is the inverse of that of the underlying benchmark.

The inverse and leveraged ETFs managed by portfolio advisors are used to speculate on or hedge other assets they own. In contrast to traditional exchange-traded funds, inverse or leveraged ETFs do not hold actual stocks. Investing in derivatives is a strategy that allows investors to profit from the performance of the indices or other metrics that they track.

These exchange-traded funds (ETFs) frequently employ complicated methods that produce surprising results. Because the prices of these funds are volatile and fluctuate up and down over time, investors who hold them for an extended time may experience a loss on both of these investments.

Private Company Investments

To raise money for their operations from investors, private companies use the private placement market to do so through the issuance of securities.

When compared to investing in publicly traded corporations, private companies can use loopholes to sell their securities directly to investors without the need for a brochure or continuous disclosure, and as a result, without the additional layers of regulatory scrutiny and protection that are provided to investors by the regulation of publicly traded corporations.

FAQ

- What factors should I consider while determining my risk tolerance?

It is a good idea to be aware of how much risk you are willing to accept, as well as the categories of danger that most concern you. When it comes to risk tolerance (how much you’re willing to risk to reap potentially greater rewards), a variety of factors come into play, including but not limited to your investment goals and experience, the amount of time you have to invest, other financial resources, and your “fear factor.”

2. How can I ensure that my portfolio generates the maximum possible returns?

Achieving an understanding of and controlling portfolio risk is one of the most crucial steps in successfully managing your portfolio’s risk. The ability to quantify risk in your portfolio allows you to maximize your possible return on investment. When you do this, you will be able to devote more capital to riskier investments that will provide higher returns.

3. Is it possible to make high-return investments that are less risky?

If you are looking for high-return investments, consider real estate investment trusts (REITs), preferred stocks, and corporate bonds.

4. What are the investments with the greatest potential for both risk and reward?

Stocks, mutual funds, forex, commodities, and options are all considered to be high-risk but high-reward investments.

Conclusion

Everyone’s circumstance is different, thus you must examine your investing time horizon, target return, and tolerance for risk to make better investment selection to meet your investment targets.

Cover Image: InvestWalls