Octamile raises $500,000 pre-seed funding. In the words of Gbenro Dara, Founder and CEO of Insurtech Startup Octamile, only 5 to 10 Africans have any form of insurance protection, even though insurance is a veritable sector that has the potential to elevate the economy of the country.

Octamile, an Insurance technology startup that enables insurance and non-insurance merchants to protect African consumers from financial loss, has raised $500,000 in pre-seed funding to fully launch its services in Nigeria.

The funding round was led by EchoVC with participation from Fiat Ventures, Kesho VC, Trade X, Verraki Partners, Dale Mathias, Kyle Daley (Founding team member of Chime) and other local and international Angels, a statement has said.

The funding round was led by EchoVC with participation from Fiat Ventures, Kesho VC, Trade X, Verraki Partners, Dale Mathias, Kyle Daley (founding team member of Chime), and other local and international angel investors, joining list of tech startups who have raised funding in 2021.

The funding also comes after months of covertly building the Insurtech startup.

What is octamile?

Founded by Gbenro Dara, Octamile’s mode of services helps both insurance and non-insurance merchants protect African consumers from financial losses.

The Insurtech sector has failed in using technology to deliver better products and services.

Insurtech startup octamile, offers an end-to-end claims management solution that can be integrated into the existing systems and processes of insurance service providers.

This enables organisations to provide a seamless claims experience while reducing administrative costs.

Furthermore, Octamile provides data, sourced from its diverse partners, which providers can leverage for improved risk profiling and pricing of customers’ assets to optimise the profitability of their insurance portfolio.

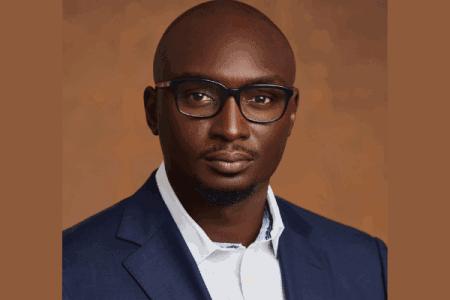

What you should know about the octamile CEO

Speaking on the launch, the Founder, CEO and the brain behind1 octamile who has spent more than 10 years in leading roles at various multinationals and technology startups, including Jumia, myautogenius, Hotels, Efritin, Cheki and Olist by Opera software.

Gbenro has a degree in insurance from the University of Lagos, Nigeria, He is also a member of the Chartered Insurance Institute of Nigeria.

“I have a background in insurance and understand the challenges,” he said. “Having spent the last decade leading and building technology businesses and exploring multiple business models and industries.

I believed it was finally time to tackle the big elephant in the room that no one wanted to tackle.” said in an interview.

According to him

“Our team has identified key areas where we add value and support the growth of the Insurance ecosystem with data and technology by partnering with traditional insurance businesses and non-insurance businesses,” said Gbenro.

He also quoted the Access to Insurance Initiative – A2ii – (a global partnership working to ensure that the worlds excluded and underserved have access to insurance); insurance allows the worlds excluded and underserved to take control of their lives and reduce their vulnerability against risks.

Hence, insurance is vital to achieving the United Nations Sustainable Development Goals (SDGs) for Africa.

What you should know about octamile

Octamile believes in unriddling easy access to and reducing friction in the insurance experience to protect Africans from financial loss.

According to Gbenga,

“Our digital insurance solution enables non-insurance businesses to offer Insurance as a feature in their already existing products.

For Insurance providers, we are powering them with the data and technology to improve customer experience, reduce administrative costs and optimise the profitability of their insurance portfolio”.

Having been described as the ‘operating system infrastructure for digital insurance in Africa, the Insurtech startup offers benefits of Digital Claims, providing seamless claims through technologies and reducing cost to its clients.

It also uses insurance technologies to Improve Risk Assessment thereby increasing Profitability of insurance portfolio businesses.

Its insurance solution also integrates insurance APIs to boost revenues of businesses, access risk profiling of individuals and merchants, and also boost the lifecycle value of existing customers through customisable APIs.

What’s next for octamile?

Speaking on the next move after raising pre-seed,

“Our team has identified key areas where we add value and support the growth of the insurance ecosystem with data and technology.”

“Our goal over the next months will be to work closely with our partners, which include AXAMansard, and FirstBank, and onboard the dozens of insurers, insurance company and startups on the waitlist ready to leverage the power of our solutions,” said Gbenro

If you enjoyed reading this article, kindly share it on social media in your WhatsApp groups and Telegram channels. Thank you